Structure a Solid Financial Foundation for University: Top Methods for Smart Preparation

As the expense of university remains to increase, it has actually ended up being significantly important for students and their family members to construct a solid financial structure for their greater education and learning. With proper planning and calculated decision-making, the desire for participating in university can come true without sinking in debt. In this discussion, we will certainly discover the top techniques for smart monetary preparation for university, consisting of setting clear goals, understanding college prices, producing a spending plan and savings strategy, discovering gives and scholarships, and taking into consideration student car loan alternatives. By applying these techniques, you can pave the means for a successful and economically safe university experience. Let's dive right into the globe of smart monetary preparation for university and find how you can make your dreams come true.

Establishing Clear Financial Goals

Establishing clear financial objectives is an essential action in efficient monetary preparation for university. As students prepare to start their higher education and learning journey, it is important that they have a clear understanding of their monetary objectives and the actions needed to achieve them.

The very first facet of setting clear financial goals is defining the expense of university. This includes looking into the tuition fees, accommodation expenditures, textbooks, and various other various prices. By having a thorough understanding of the financial requirements, trainees can establish achievable and realistic goals.

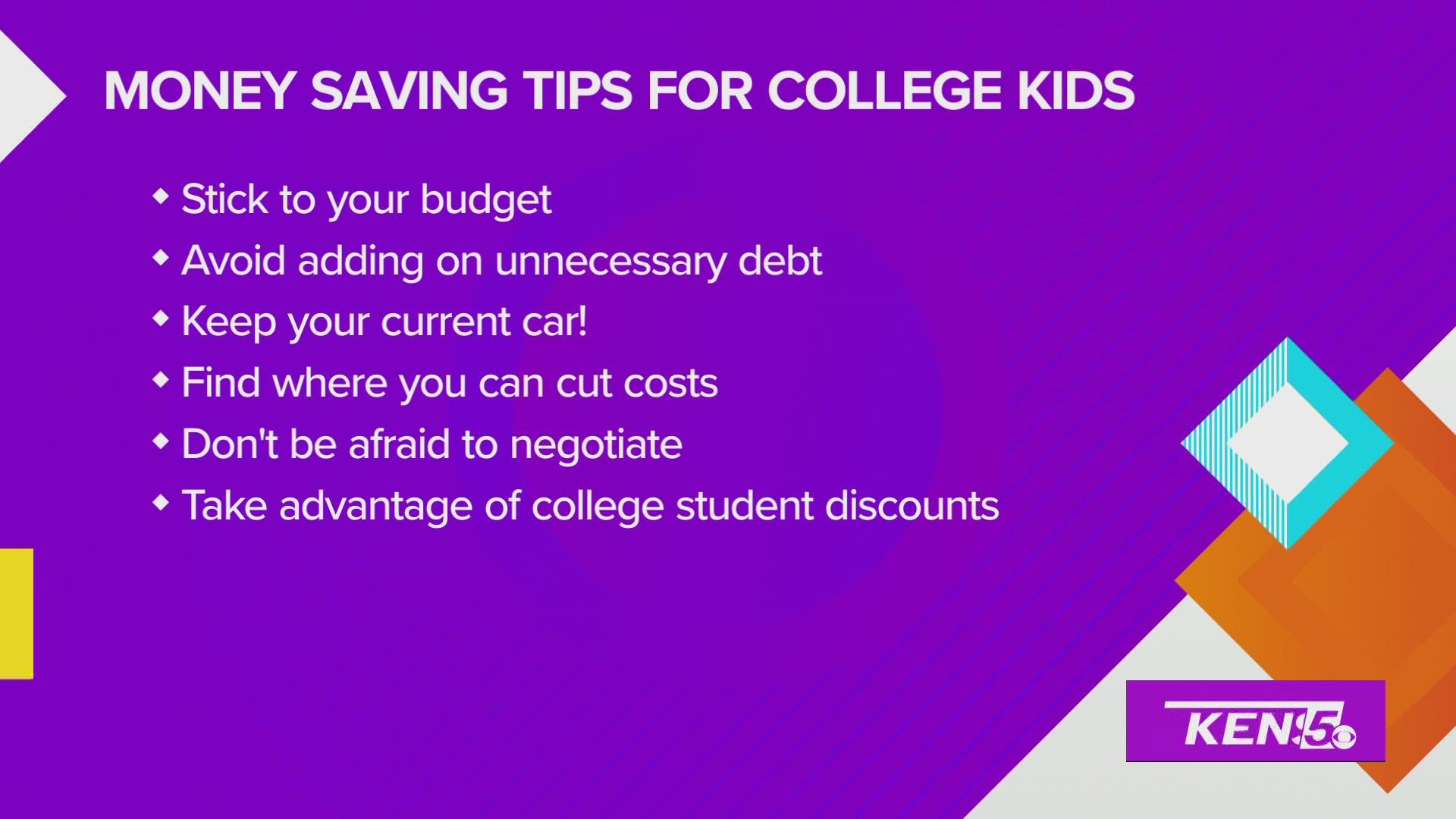

Once the cost of university has been identified, students must develop a spending plan. This includes evaluating their earnings, including scholarships, gives, part-time work, and parental payments, and then allocating funds for required expenditures such as real estate, food, and tuition. Creating a budget aids trainees prioritize their costs and makes sure that they are not overspending or collecting unneeded financial obligation.

In addition, setting clear monetary objectives also includes identifying the need for cost savings. Students ought to figure out just how much they require to save every month to cover future expenditures or emergencies. By setting a savings objective, students can create healthy and balanced monetary practices and plan for unexpected situations.

Understanding University Costs

Understanding these costs is essential for effective economic preparation. It is vital for pupils and their households to extensively research and recognize these expenses to produce a realistic budget and financial strategy for college. By understanding the numerous elements of university expenses, individuals can make educated choices and stay clear of unnecessary financial tension.

Producing a Budget Plan and Financial Savings Plan

Producing a comprehensive budget plan and cost savings plan is important for reliable financial preparation during college. Begin by listing all your sources of revenue, such as part-time jobs, scholarships, or financial help. It calls for constant tracking and modification to ensure your financial security throughout your college years.

Exploring Scholarships and Grants

To maximize your economic sources for university, it is vital to check out offered scholarships and grants. Save for College. Scholarships and gives are an excellent method to finance your education and learning without needing to rely greatly on financings or individual cost savings. These monetary help are typically awarded based upon a selection of variables, such as academic success, sports performance, extracurricular involvement, or economic requirement

Start by investigating gives and scholarships used by institution of higher learnings you want. Several organizations have their very own scholarship programs, which can supply considerable economic aid. Furthermore, there are numerous outside scholarships available from foundations, organizations, and organizations. Web sites and on the internet data sources can help you discover scholarships that match your credentials and passions.

When making an application for scholarships and gives, site it is vital to pay close focus to target dates and application demands. A lot of scholarships call for a finished application, an essay, letters of recommendation, and transcripts. Save for College. See to it to adhere to all guidelines thoroughly and send your application ahead of the deadline to enhance your opportunities of getting financing

Discovering Trainee Financing Alternatives

When thinking about how to fund your university education and learning, it is necessary to explore the numerous choices available for pupil financings. Trainee lendings are a usual and hassle-free method for students to cover the costs of their education and learning. Nevertheless, it is essential to recognize the different sorts of trainee lendings and their terms prior to choosing.

Another option is personal trainee loans, which are provided by financial institutions, debt unions, and other private loan providers. These fundings commonly have higher rates of interest and a lot more rigid payment terms than federal car loans. If government lendings do not cover the complete expense of tuition and other expenditures., exclusive loans might be required.

Conclusion

To conclude, developing a strong financial foundation for college needs setting clear goals, comprehending the expenses included, producing a budget plan and cost savings plan, and exploring scholarship and grant opportunities. It is important to think about all offered alternatives, consisting of pupil financings, while decreasing individual pronouns in an academic composing design. By adhering to these methods for smart planning, pupils can browse the monetary elements of college and lead the way for an effective scholastic trip.

As the price of university continues to rise, it has actually ended up being progressively essential for students and their families to construct a solid financial structure for their higher education. In this conversation, we will explore the leading methods for wise financial planning for college, consisting of setting clear goals, recognizing college expenses, creating a spending plan and cost savings plan, discovering scholarships and grants, and taking into consideration trainee lending alternatives. It is essential for students and their family members to completely study and comprehend these expenses to create a realistic spending plan and financial strategy for college. These monetary help are generally granted based on a variety of variables, such as academic success, sports performance, extracurricular participation, or financial demand.

By following these click resources strategies for wise preparation, students can navigate the financial elements of university and lead the way for a successful scholastic journey.